In the world of technical analysis, candlestick patterns are widely used to predict future price movements in financial markets. Among these patterns, the shooting star candlestick holds a special place. Its distinct shape and characteristics offer valuable insights into market sentiment and potential trend reversals.

In this article, we will explore shooting star candlestick patterns in detail, learn how to identify them on price charts, and discuss their significance in trading strategies.

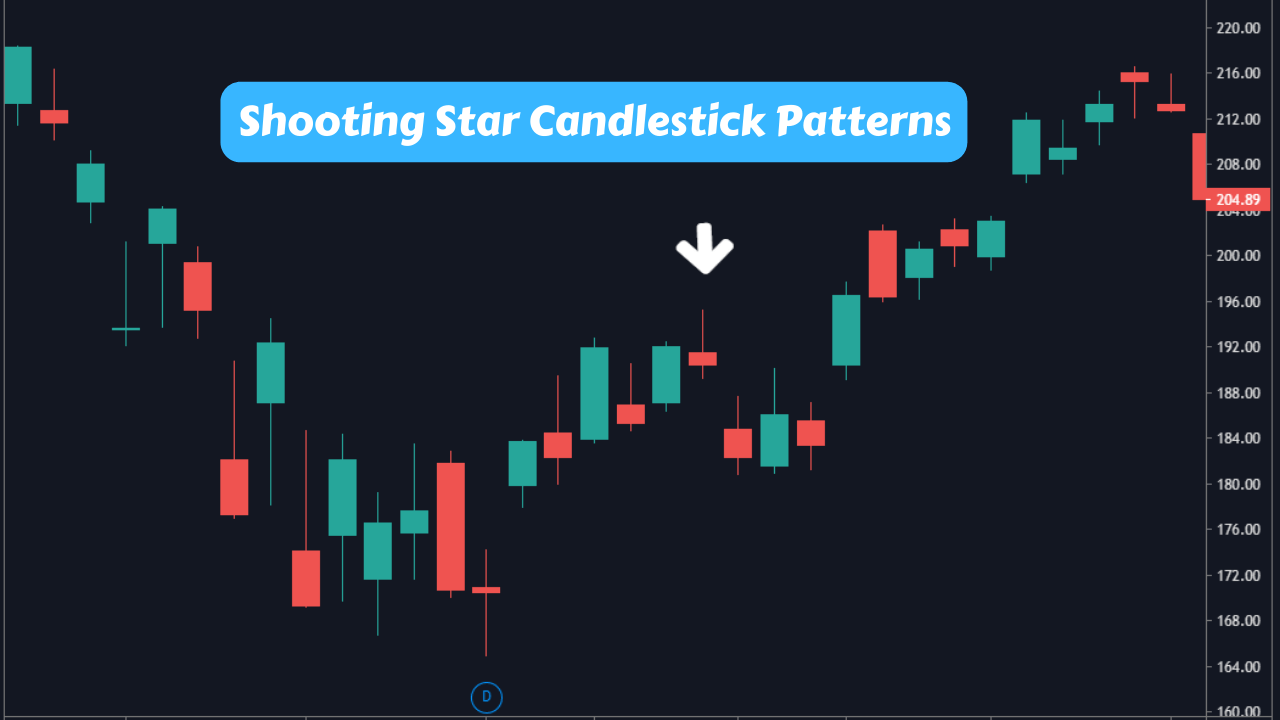

Shooting Star Candlestick Patterns

Candlestick charts originated in Japan and have been used for centuries to analyze the price movements of rice in the commodities market. Over time, they gained popularity in other financial markets as well. Candlestick patterns provide traders with visual cues about market psychology and offer a deeper understanding of price action.

Understanding Candlestick Patterns in Technical Analysis

Before diving into shooting star candlestick patterns, it is essential to grasp the basics of candlestick analysis. A candlestick consists of a body and wicks (also known as shadows) at each end. The body represents the price range between the opening and closing prices for a specific time period, while the wicks indicate the highest and lowest prices reached during that period.

What is a shooting star candlestick?

A shooting star candlestick is a bearish reversal pattern that forms at the end of an uptrend. It signifies a potential trend reversal from bullish to bearish. The pattern is characterized by a small body located at the lower end of the price range, with a long upper wick that is at least two times the length of the body.

Characteristics of a shooting star candlestick

To identify a shooting star candlestick, look for the following characteristics:

Interpretation of shooting star candlestick patterns

When a shooting star candlestick appears after an extended uptrend, it suggests that the buying pressure is weakening, and sellers are gaining control. The long upper wick indicates that prices were pushed higher during the session but ultimately rejected, leading to a potential reversal.

Bullish shooting star patterns

While shooting star candlesticks are commonly associated with bearish reversals, there are instances where they can act as bullish signals. Bullish shooting stars can occur during a downtrend and signify a potential trend reversal to the upside. Traders should pay attention to the overall market context when interpreting shooting star patterns.

Formation and characteristics of bullish shooting star patterns:

Bullish shooting star patterns form when the market is in a downtrend. The pattern consists of a small body located at the upper end of the price range, with a long lower wick that is at least two times the size of the body. The upper wick may be absent or very small.

The interpretation of a bullish shooting star pattern is that the selling pressure is diminishing, and buyers are starting to gain control. The long lower wick indicates that prices were pushed lower during the session but ultimately rejected, signaling a potential reversal to the upside.

Traders should be cautious when identifying bullish shooting star patterns and consider other confirming factors such as support levels, trendlines, or other technical indicators. These additional factors help validate the potential bullish reversal suggested by the shooting star pattern.

Bearish shooting star patterns

The bearish shooting star pattern is the more common and well-known interpretation of shooting star candlesticks. It occurs at the end of an uptrend and suggests a potential trend reversal to the downside.

Formation and characteristics of bearish shooting star patterns:

Bearish shooting star patterns are characterized by a small body located at the lower end of the price range, with a long upper wick that is at least two times the size of the body. The lower wick may be absent or very small.

The presence of a bearish shooting star pattern indicates that the buying pressure is diminishing, and sellers are gaining control. The long upper wick represents the attempt by buyers to push prices higher, but ultimately, the selling pressure overcomes the buying pressure, leading to a potential reversal.

Traders should consider other confirming signals such as resistance levels, trendlines, or other technical indicators to validate the potential bearish reversal suggested by the shooting star pattern.

Identifying shooting star patterns on price charts

To effectively use shooting star patterns in trading, it is crucial to identify them accurately on price charts. Here are some key steps to follow:

It is essential to note that shooting star patterns should not be considered in isolation. Confirmation from other technical analysis tools and indicators can increase the accuracy of the signals.

Using shooting star patterns in trading strategies

Shooting star candlestick patterns can be incorporated into trading strategies to determine entry and exit points, as well as to set stop-loss and take-profit levels.

Entry and exit points:

Traders can use shooting star patterns as entry points for trades. For bearish shooting star patterns, traders may consider opening short positions or selling their existing positions. For bullish shooting star patterns, traders may consider opening long positions or buying into the market.

To determine exit points, traders can use support and resistance levels, Fibonacci retracement levels, or other technical indicators. These levels help identify potential price targets or areas where the trend may reverse.

Stop-loss and take-profit levels:

To manage risk, traders should set stop-loss orders below the low of a bearish shooting star pattern or above the high of a bullish shooting star pattern. This helps protect against potential losses if the market moves against the anticipated reversal. Take-profit levels can be set based on various factors such as previous support or resistance levels, Fibonacci extension levels, or profit targets determined by the trader’s risk-reward ratio. Taking profits at these levels ensures that traders capture gains and avoid potential reversals.

Limitations and Considerations when using Shooting Star Patterns

While shooting star patterns can provide valuable insights into market reversals, it is essential to be aware of their limitations and consider other factors when making trading decisions.

Confirmation signals:

Shooting star patterns should be confirmed by other technical indicators or candlestick patterns before taking action. Relying solely on shooting stars may result in false signals and poor trading decisions. Look for confirmation from indicators like moving averages, trendlines, or other reversal patterns such as engulfing patterns or doji candles.

False signals and reliability:

Not all shooting star patterns lead to significant trend reversals. Some shooting star patterns may result in temporary price retracements rather than full-fledged reversals. Traders should be cautious and use shooting stars in conjunction with other analysis techniques to enhance reliability.

Combining shooting star patterns with other indicators

To improve the accuracy of trading signals, traders often combine shooting star patterns with other technical indicators. Here are a few examples:

Moving averages:

Using moving averages in conjunction with shooting star patterns can provide confirmation of a potential trend reversal. If a shooting star appears near a key moving average, such as the 50-day or 200-day moving average, it strengthens the signal for a reversal.

Support and resistance levels:

Shooting star patterns that form near significant support or resistance levels increase the likelihood of a trend reversal. When shooting stars coincide with these levels, they provide additional confirmation and enhance the trading signal.

By combining shooting star patterns with other technical analysis tools, traders can gain a more comprehensive understanding of market conditions and increase the probability of successful trades.

Real-life examples and case studies

To illustrate the practical application of shooting star patterns, let’s explore a real-life example:

Example:

Suppose you are analyzing the price chart of a stock that has been in a strong uptrend for several weeks. You notice a shooting star candlestick pattern forming at the end of the trend, with a small body and a long upper wick. The pattern also coincides with a major resistance level.

Given the shooting star pattern’s characteristics and the presence of the resistance level, you interpret this as a potential bearish reversal signal. You decide to open a short position, setting your stop-loss order above the shooting star’s high and targeting a profit at the nearest support level.

Over the following days, the stock price indeed reverses, confirming the accuracy of the shooting star pattern. You successfully capture a profit from the price decline.

Tips for incorporating shooting star patterns into your trading routine

Here are some tips to help you effectively incorporate shooting star patterns into your trading routine:

By following these tips and continuously refining your trading approach, you can maximize the effectiveness of shooting star patterns in your trading routine.

Conclusion

Shooting star candlestick patterns are powerful tools in technical analysis, providing insights into potential trend reversals. Whether they appear at the end of an uptrend as bearish signals or during a downtrend as bullish signals, shooting star patterns offer valuable information about market sentiment and the balance between buyers and sellers.

When incorporating shooting star patterns into your trading strategy, remember to consider confirmation signals, be aware of false signals, and combine them with other technical indicators for stronger signals. Practice risk management and stay updated with market news to adapt your trading decisions accordingly.

With diligent analysis, proper interpretation, and careful execution, shooting star patterns can contribute to your trading success by identifying profitable entry and exit points in the dynamic world of financial markets.

FAQs (Frequently asked Questions)

Can shooting star patterns be used in any financial market?

Yes, shooting star patterns can be used in various financial markets, including stocks, forex, commodities, and cryptocurrencies. The principles behind shooting star patterns remain consistent across different markets.

How long should the wick be to qualify as a shooting star pattern?

The upper wick of a shooting star pattern should be at least twice the size of the body. This ensures a clear distinction between the body and the wick, indicating a significant rejection of higher prices during the session.

Are shooting star patterns reliable for predicting trend reversals?

While shooting star patterns can provide valuable insights into potential trend reversals, they should be confirmed by other technical indicators or price action signals. False signals can occur, so it is important to consider additional factors before making trading decisions.

Can shooting star patterns be used in combination with other candlestick patterns?

Yes, shooting star patterns can be combined with other candlestick patterns to strengthen trading signals. For example, a shooting star pattern appearing after a bullish engulfing pattern or at a key resistance level may provide a more robust reversal signal.

How often do shooting star patterns occur?

The frequency of shooting star patterns depends on the market conditions and the timeframe you are analyzing. In general, shooting star patterns may not occur frequently, but they can provide high-quality trading opportunities when they align with other technical factors.